Aging in place for boomers: A guide to Senior Living

Senior housing: Where the days are long, the nights are short, and the cocktails are constantly flowing

"Senior housing" encompasses a diverse spectrum of living options designed to support older adults through their aging journey. Today's senior living landscape offers unprecedented choice, allowing individuals to select communities that match their lifestyle preferences, care needs, and financial resources. Think of it as a comprehensive continuum of care – each option tailored to different stages of aging and levels of independence.

Senior Housing Categories and Choices

The modern senior living ecosystem has evolved far beyond traditional nursing homes, offering innovative models that emphasize lifestyle, wellness, and community engagement:

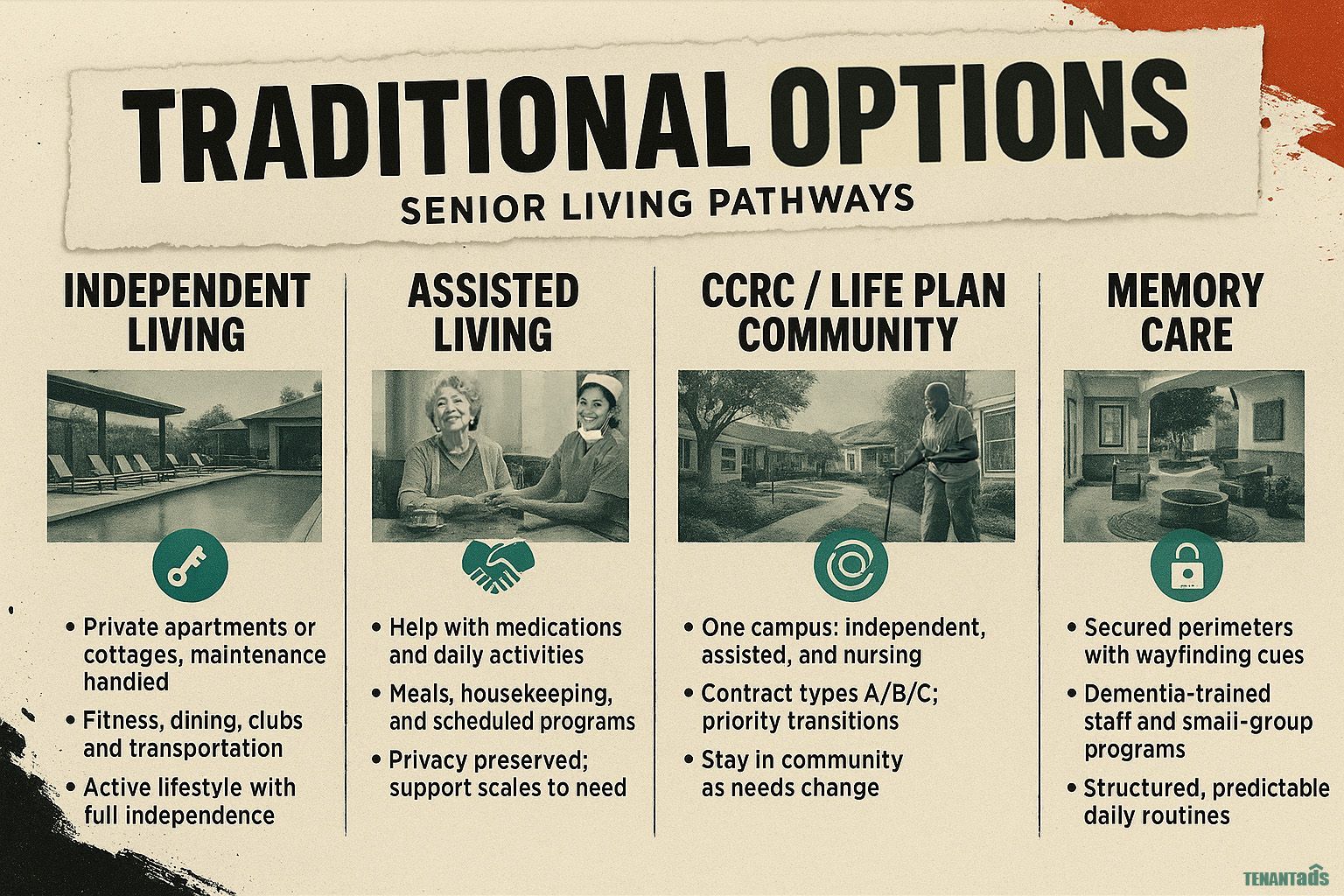

Traditional Senior Offerings

- Independent Living Communities: Self-contained apartments or cottages within age-restricted communities offering maintenance-free living, social programs, and amenities like fitness centers, dining venues, and transportation services. Residents maintain complete independence while enjoying an active, social lifestyle.

- Assisted Living Facilities: Private apartments with personalized support services including medication management, daily living assistance, housekeeping, and meals. Residents receive help as needed while maintaining dignity and autonomy.

- Continuing Care Retirement Communities (CCRCs): Comprehensive communities offering the full continuum of care – from independent living through skilled nursing – all on one campus. Residents can transition between care levels without needing to relocate, providing peace of mind for the future.

- Skilled Nursing Facilities: Medical-model communities providing 24/7 nursing care, rehabilitation services, and complex medical management for those requiring intensive healthcare support.

- Memory Care Communities: Specialized environments designed for individuals with Alzheimer's disease and other dementias, featuring secured perimeters, specialized programming, and staff trained in dementia care best practices.

Emerging Models (2025)

- Active Adult Communities: Age 55+ lifestyle communities focusing on wellness, recreation, and social engagement. Currently experiencing 92.3% occupancy – the highest in the sector – these communities attract younger, healthier seniors seeking vibrant retirement living.

- Co-operative Senior Housing: Innovative ownership models where residents purchase shares in the community, building equity while accessing services. The Ebenezer model in Minnesota is pioneering this affordable alternative to traditional senior living.

- Mixed-Use Developments: Urban communities integrating senior housing with retail, healthcare, and dining, creating walkable neighborhoods that combat isolation and promote engagement with the broader community.

- University-Based Communities: Intergenerational living environments on or near college campuses, offering lifelong learning opportunities, mentorship programs, and access to university amenities.

- PACE Centers: Program of All-Inclusive Care for the Elderly provides comprehensive medical and social services, enabling participants to remain in their homes while receiving coordinated care.

Management inside the House

Property management in senior living combines traditional multifamily expertise with specialized services tailored to the needs of older residents, creating environments where independence meets support.

Core Management Functions

- Staffing: Building teams that blend hospitality with care awareness. Today's communities employ a diverse range of professionals, from concierges to wellness coordinators, all trained in meeting the specific needs of seniors. With labor costs rising 4.6-6% annually, properties are implementing AI-powered scheduling and efficiency models to maintain service quality while controlling expenses.

- Maintenance: Prioritizing safety and accessibility through preventive maintenance programs. Teams focus on installing grab bars, achieving optimal lighting, ensuring slip-resistant surfaces, and maintaining elevator reliability. Innovative building technology now predicts maintenance needs, resulting in a 40% reduction in emergency calls.

- Resident Engagement: Creating vibrant social environments through evidence-based programming. Modern communities offer 15-20 monthly programs, including fitness classes, technology training, cultural outings, and intergenerational activities. Engaged residents report 23% higher satisfaction and maintain independence longer.

- Healthcare Coordination: Facilitating connections to healthcare resources without providing direct medical care. Staff assist with appointment scheduling, medication delivery coordination, and access to home health providers. Many communities now feature telehealth kiosks and visiting physician programs.

- Financial Management: Balancing affordability with operational sustainability. Properties are shifting from expensive third-party referrals to in-house digital marketing, resulting in a 40% reduction in acquisition costs. Energy management systems and shared services agreements help control operating expenses.

Operational Innovation

- Technology integration reduces administrative burden by 30%

- Centralized services shared across multiple properties

- Predictive analytics for occupancy and maintenance planning

- Digital platforms for resident communication and service delivery

Some Statistics regarding Senior Housing

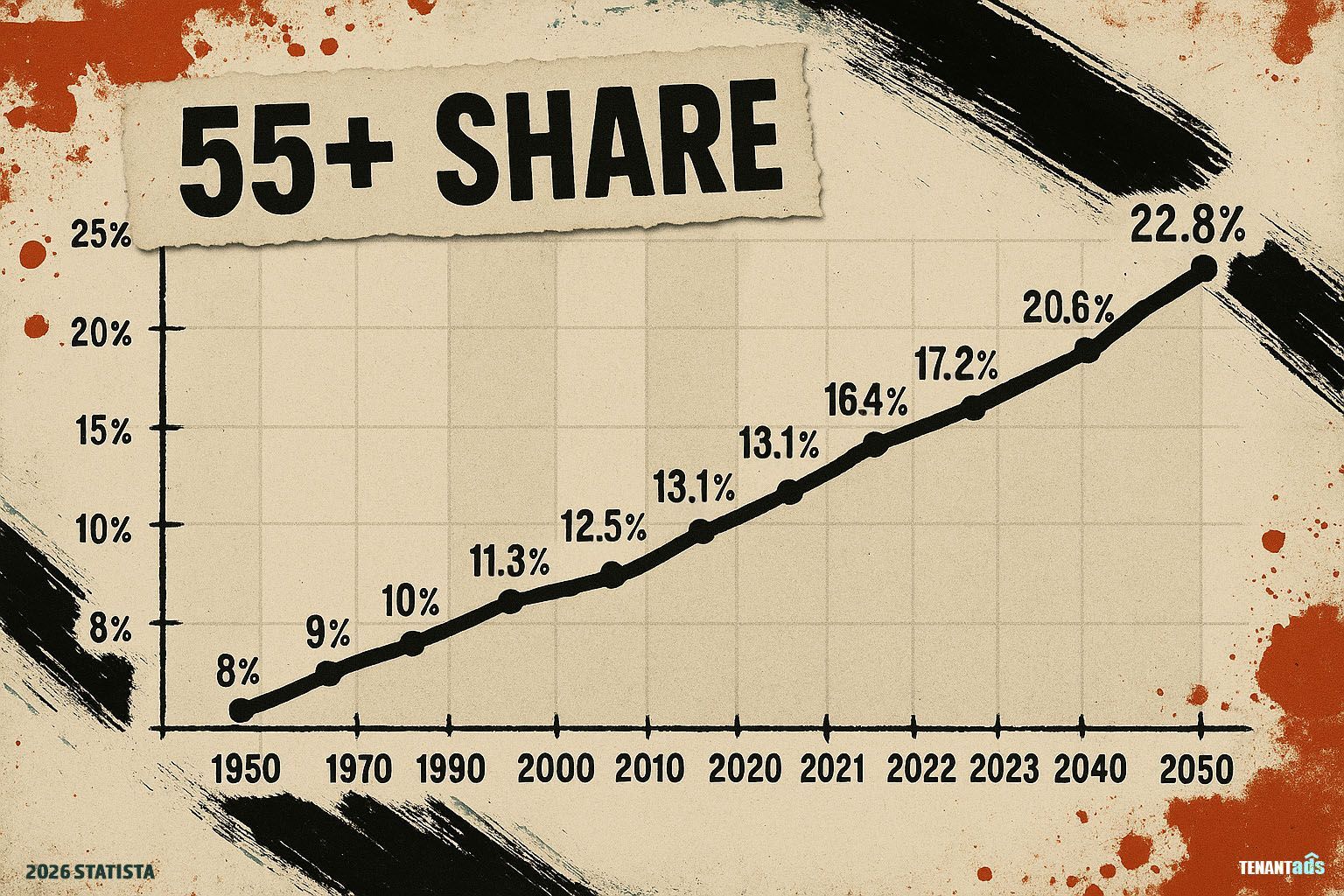

The senior living sector is experiencing unprecedented demographic tailwinds.

Population Dynamics:

- By 2060, nearly 25% of Americans will be 65+ (up from 18% today)

- The oldest baby boomers turn 80 in 2025 – a critical demand inflection point

- 73 million Americans will be 65+ by 2030

Supply-Demand Imbalance:

The senior housing industry faces an unprecedented supply crisis that threatens to leave millions of aging Americans without adequate housing options. As the baby boomer generation enters their 80s—the age when senior housing needs typically accelerate—the industry's development pipeline has virtually dried up due to rising construction costs, labor shortages, and tighter lending standards. This perfect storm of high demand and constrained supply is creating both a societal challenge and an investment opportunity that will define the sector for the next decade.

- 560,000 new units needed by 2030 to meet demand

- Only 191,000 units projected at current development pace

- Annual construction starts: <10,000 units (lowest since 2009)

Market Size and Investment:

The economic magnitude of the senior housing sector reflects its critical role in America's healthcare and social infrastructure. Major institutional investors and REITs are deploying billions in capital to acquire existing properties, often at prices below replacement cost, recognizing that the demographic wave ahead virtually guarantees strong returns. The affluence of the baby boomer generation, with substantial home equity accumulated over decades of appreciation, provides a solid financial foundation for the sector's growth. However, affordability remains a challenge for middle-income seniors who don't qualify for subsidies but struggle with market rates.

- Market value: $92.6 billion (2023) → $118.17 billion (2028) projection

- Welltower invested $6.2 billion in acquisitions in 2024

- 40%+ of boomers can afford senior housing from income alone

The average home equity for Baby Boomers is $250,000. Because many older individuals need suitable places to live, large organizations like Welltower, Inc.

Industry Recovery and Growth Phase

The senior living industry has transitioned from a period of pandemic recovery to one of sustained growth.

Current Performance (Q2 2025):

The current operational metrics tell a story of sustained momentum that shows no signs of slowing. Quarter after quarter, absorption continues to outpace new supply, driving occupancy rates toward levels that will necessitate significant new development. The stabilization of rent growth at sustainable levels above inflation provides operators with predictable revenue streams while remaining manageable for residents. This balanced growth trajectory, combined with operational improvements and technology adoption, positions the industry for what many analysts are calling a "golden decade" of senior housing.

- Occupancy: 88.1% after 16 consecutive quarters of growth

- Annual absorption: 35,000+ units (exceeding new supply)

- Rent growth: 4-4.3% annually (stabilized from pandemic volatility)

- NIC projection: 92% occupancy by the end of 2026

Investment Climate:

The investment landscape for senior housing has shifted from opportunistic to strategic, with sophisticated investors recognizing the sector's transition from alternative to essential real estate. The ability to acquire quality properties at a price below replacement cost creates an unusual arbitrage opportunity. At the same time, the demographic certainty of demand provides downside protection, which is rare in the commercial real estate sector. This convergence of factors has led to competitive bidding for high-quality assets and a broadening of the investor base to include sovereign wealth funds, pension funds, and insurance companies, which seek long-term, stable returns that align with their liability profiles.

- 57% of investors expect cap rate compression in 2025

- REITs acquiring properties below replacement cost

- Strong fundamentals driving institutional investment

- Focus shifting to middle-market and affordable options

The phrase "survive till '25" has transformed into "thrive in '25" as operators capitalize on favorable demographics and limited new supply.

Technology and Innovation

Senior living is experiencing a technology revolution that enhances safety, engagement, and operational efficiency.

Smart Home Integration:

Smart home technology in senior living has become essential, enhancing safety and dignity. It learns routines and quickly responds to emergencies. Early adopters report a 40% decrease in fall-related hospitalizations and a 30% increase in medication adherence.

- AI-powered fall detection and health monitoring systems

- Voice-activated controls for lighting, temperature, and emergency calls

- Predictive analytics identifying health changes before crises occur

- 50% of US households will be smart-enabled by 2025

Operational Technology:

Behind-the-scenes operational technology has revolutionized how senior living communities manage the complex intersection of hospitality, healthcare, and housing. These integrated systems create seamless workflows that free staff from administrative tasks, allowing them to spend more time on resident interaction and care delivery. The implementation of electronic health records that communicate across care settings has reduced medication errors by 25% and significantly improved care coordination. Communities utilizing comprehensive operational technology platforms report 20% improvements in staff productivity and 15% reductions in operational costs.

- Electronic health records integration

- Automated medication dispensing systems

- Virtual reality programs for cognitive stimulation

- Robotic assistants for routine tasks

Digital Engagement:

The stereotype of technology-averse seniors has been thoroughly debunked as residents embrace digital tools that enhance their social connections, learning opportunities, and daily convenience. Modern senior living communities are creating digital ecosystems that rival those found in luxury hotels, with apps that handle everything from dining reservations to telehealth appointments. The success of these platforms—with 65% adoption rates among residents—demonstrates that when technology is designed with seniors in mind and supported adequately with training, it becomes an enabler of independence rather than a barrier to engagement.

- Resident apps for program registration and communication

- Telehealth platforms reducing hospital visits by 35%

- Family portals for care updates and virtual visits

- 65% of senior residents actively use digital platforms

Value-Based Care Models

The shift toward value-based care in senior living represents a fundamental realignment of incentives, moving from volume-based fee-for-service models to outcomes-focused integrated care. Both regulatory pressures and market demands for better care coordination, improved outcomes, and cost containment drive this transformation. Communities that have successfully implemented value-based care models report not only improved clinical outcomes but also higher resident satisfaction and enhanced financial performance through reduced hospitalizations and more effective management of chronic conditions.

PACE Programs:

- Comprehensive care coordination for those 55+

- No copays, deductibles, or coverage gaps

- 95% of participants avoid nursing home placement

- Currently available in 33 states.

Managed Care Partnerships:

- Integration with Medicare Advantage plans

- Risk-sharing arrangements with health systems

- Focus on preventive care and wellness

- 20% reduction in hospital readmissions

Conclusion: The Future of Senior Living

The senior living landscape in 2025 represents a fundamental shift from the crisis mode of the pandemic era to an industry positioned for transformative growth. With occupancy approaching 90% and the oldest baby boomers reaching 80, the sector faces both unprecedented opportunity and significant challenges.

The critical supply-demand imbalance – with only 191,000 units projected against 560,000 needed by 2030 – creates urgency for innovation in development models, technology adoption, and care delivery. Successful operators are those who embrace technology not as a luxury, but as essential infrastructure, implementing value-based care models that improve outcomes while managing costs, and creating communities that reflect the desires of modern seniors for engagement, purpose, and continued growth.

The industry's evolution from "survival" to "thrival" mode signals a new era where senior living is viewed not as a last resort but as a lifestyle choice that enhances independence, social connection, and quality of life. As Generation X approaches retirement age and millennials become key decision-makers for their parents' care, the sector must continue evolving to meet changing expectations while addressing the critical need for affordable, middle-market options.

For investors, operators, and families alike, senior living in 2025 and beyond represents both a compelling opportunity and a societal imperative – creating communities where aging is not about decline but about continued vitality, connection, and purpose.