5 Best Long-term Investments in 2024

We are about to enter 2024, and the financial environment is constantly in flux, like always, driven by economic forces, technological advancements, and global events. Securing financial stability and building wealth over the long term remains a top priority for many. The year 2024 presents both challenges and opportunities, making it an opportune time to reassess your investment strategy and explore the best options for long-term growth.

Traditional wealth creation methods, such as savings accounts and fixed deposits, offer minimal returns, prompting investors to seek alternative investment options to safeguard and expand their assets. This article delves into various investment choices and strategies to aid in informed decision-making for the years ahead.

The investment landscape has undergone significant transformations in recent years, necessitating adaptation while remaining true to financial objectives. From the expanding realm of digital currencies to the growing emphasis on sustainable and ethical investments, investors have more choices than ever before.

While these options offer opportunities, they also come with varying degrees of risk, reward, and complexity.

Whether you're a seasoned investor or just starting your wealth-building journey, understanding potential investment avenues, strategies, and prudent financial management principles is essential. This article explores some of the most promising long-term investments to consider as you navigate the financial landscape in 2024 and beyond.

Please note that the information provided is intended to offer insights and ideas to help you initiate your investment journey. Thorough research, consultation with financial experts, and tailoring investment decisions to your specific financial circumstances and objectives are crucial. Let's explore the available options as you embark on your path toward financial security and prosperity in the years to come.

Laying the Foundation for Investment

Investing is not merely a financial transaction; it's a journey toward financial empowerment and security. To go aboard on this journey effectively, it's crucial to lay a strong foundation, much like building a sturdy house.

This foundation is built on seven essential pillars (link of Blog 19), each designed to ensure your investments align with your objectives and stand the test of time.

1. Establish Clear Financial Goals: Determine what you want to achieve with your investments.

2. Timeframe Management: Align your investment strategies with your investment horizon.

3. Harnessing the Power of Early and Consistent Investing: Start investing early and contribute regularly to maximize long-term returns.

4. Evaluating Potential Returns: Assess the potential return on investment and align it with your risk tolerance.

5. Prioritizing Liquidity: Maintain a portion of your assets in readily accessible forms.

6. Embracing Diversification: Spread your investments across different asset classes and industries to mitigate risk.

7. Vigilance Against Scams: Stay informed about financial scams and protect your investments.

5 Best investment approaches in 2024

While exploring the world of investments, these can be done through various approaches, whether you choose to engage a traditional financial advisor, utilize a robo-advisor, or take the reins and manage your investments independently. Platforms like Charles Schwab, Fidelity, and Vanguard, along with numerous mobile apps, provide investors with the tools to manage their portfolios and execute trades in real-time, catering to those who prefer hands-on control or on-the-go flexibility.

However, it's crucial to recognize that long-term investment strategies differ significantly from day trading. Your investment choices should align with your extended investment horizon, tailoring your portfolio to match your specific goals and timelines. For instance, an investment strategy with a 20-year or 30-year outlook will differ from one where you'll need access to funds within the next year.

Global ETFs: The All-Rounder of Investing

Global exchange-traded Funds (ETFs) have surged in popularity as a 'go-to' investment choice in recent years, and for good reason. Just like the Big Mac, a global ETF offers a highly diversified portfolio, making it a valuable asset during times of market volatility, such as the early 2023 market shift, where a mere handful of mega-cap US stocks accounted for 80% of S&P growth. Active fund managers may not have held these stocks in their portfolios, leading to significant underperformance.

Passive investments, on the other hand, provide broad exposure to thousands of listed stocks, effectively shielding your portfolio from the impact of individual stock fluctuations. Overwhelming evidence supports the passive approach to investing. According to Ibbotson Associates, from 1926 to 2022, a diversified portfolio of large stocks (the S&P 500) yielded an impressive 10.3% compound annual rate of return.

Global ETFs take diversification a step further, offering access to hundreds of asset classes, a feat that active managers, unless they have the Midas touch of a LeBron James or Lionel Messi, are unlikely to replicate.

Index funds

Index funds are a good choice for long-term investment because they provide exposure to a broad market, such as the S&P 500. This diversification helps to reduce risk and improve returns over time. The appeal of index funds lies in their simplicity and potential for long-term growth. This investment vehicle has garnered immense popularity due to its low cost, efficiency, and consistent historical performance. Investors are increasingly recognizing the advantages of index funds as they seek a hassle-free approach to building wealth over the years.

Rental Apartments

When it comes to long-term investments, real estate has always held a prominent place in the portfolios of many savvy investors. Among the real estate options available, rental apartments stand out as a viable and potentially lucrative choice. The appeal of investing in rental apartments lies in their ability to generate both consistent income and capital appreciation over time. These properties offer a source of passive income, provide an opportunity for portfolio diversification, and can serve as a hedge against inflation.

In this article, we'll explore the advantages of investing in rental apartments with a long-term perspective, delving into factors such as cash flow potential, property appreciation, tax benefits, and the essential considerations for success in the rental property market. Whether you're an experienced investor looking to expand your real estate portfolio or a newcomer considering real estate as a long-term investment, understanding the benefits of rental apartments (blog 18 link – 9 factors to consider before investing in rental apartments) can help you make informed decisions for a prosperous financial future.

Cryptocurrency

The world of cryptocurrency has been characterized by extreme volatility in recent times. While opinions among financial experts differ on whether cryptocurrency should be part of a long-term investment portfolio, some suggest that individuals with a higher risk tolerance may want to explore this option. Cryptocurrency can offer a unique avenue for potential growth, though it's advisable not to put all your financial eggs in this digital basket.

Some financial advisors recommend considering a small allocation to cryptocurrency, like Bitcoin, as a part of a long-term wealth-building strategy. Additionally, you might explore investment trusts such as Grayscale Bitcoin Trust (GBTC), which allow exposure to Bitcoin through a more traditional investment vehicle.

However, it's essential for investors contemplating cryptocurrency as a long-term investment to weigh the advantages and disadvantages of managing their own digital assets. Cryptocurrencies, including Bitcoin, require a different level of safety and security compared to conventional investments.

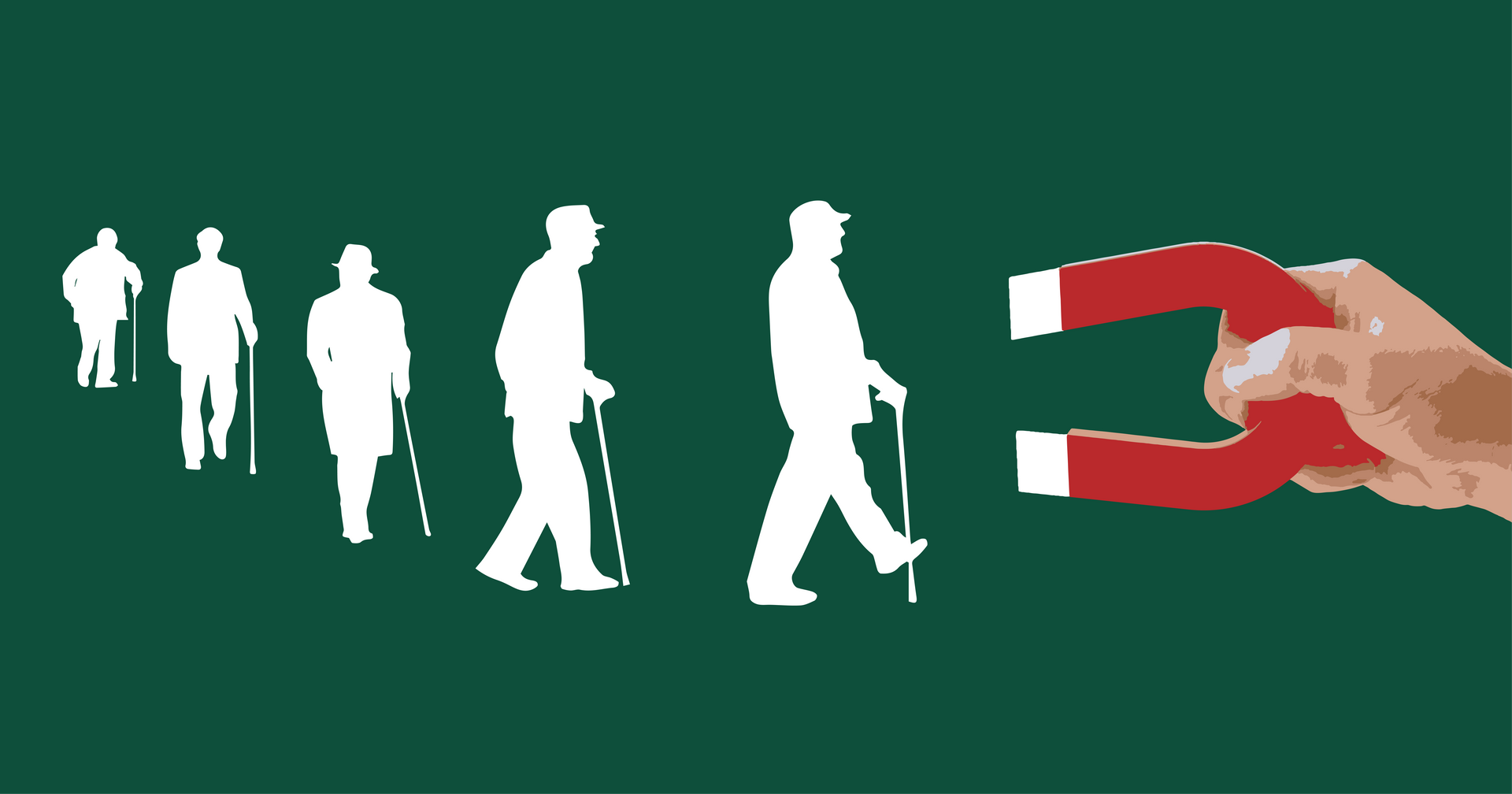

Yourself

While traditional investments in stocks, bonds, and real estate can undoubtedly contribute to your financial well-being, one of the most valuable investments you can make is in yourself. Investing in your personal growth, skills, and knowledge can yield immense returns over the long term, not only in terms of financial gains but also in terms of personal fulfillment and overall life satisfaction Blog 21 link somewhere.

1. Continuous Learning:

Embrace lifelong learning as a cornerstone of your self-investment strategy. Dedicate time to acquiring new skills, expanding your knowledge base, and exploring areas of interest. Whether it's enrolling in online courses, attending workshops, or delving into books and articles, continuous learning keeps your mind sharp, enhances your problem-solving abilities, and opens doors to new opportunities.

2. Health and Wellness:

Your physical and mental well-being are crucial for long-term success. Prioritize healthy eating habits, regular exercise, and adequate sleep. Engage in activities that bring you joy and relaxation, such as spending time in nature, practicing mindfulness, or pursuing hobbies. A healthy and balanced lifestyle enhances your energy levels, improves focus, and boosts overall resilience.

3. Personal Relationships:

Nurture strong and supportive relationships with family, friends, and mentors. Surround yourself with individuals who inspire you, challenge you to grow, and provide a sense of belonging. Strong social connections contribute to your emotional well-being, provide a network of support, and can lead to unexpected opportunities.

4. Skill Development:

Identify your unique talents and interests and invest in developing valuable skills. Whether it's mastering a new language, acquiring technical expertise, or enhancing communication skills, continuous skill development makes you more marketable, enhances your career prospects, and increases your earning potential.

5. Self-Reflection and Growth:

Regularly engage in self-reflection to identify areas for personal growth. Assess your strengths, weaknesses, and aspirations. Set clear goals for yourself and develop strategies to achieve them. Seek feedback from trusted mentors and advisors to gain valuable insights and perspectives.

Conclusion

As we enter 2024, the investment landscape offers both challenges and opportunities. Building a strong financial foundation is crucial, with pillars such as clear goals, time management, and diversification. Consider diverse options like global ETFs, index funds, rental apartments, cryptocurrency, and personal development. Remember to research, consult experts, and prioritize your long-term financial well-being. By investing wisely and in yourself, you can navigate the evolving financial terrain with confidence.