9 Factors to Consider Before Investing in Rental Apartments

If your free time is spent watching home improvement shows and browsing property listings, it may be time to take real estate investing seriously. Rental apartments hold the key to smart investing, as they provide a steady and long-term income stream.

Are you seeking a residential rental property that can enhance the performance of your investment portfolio? The world of investment properties offers an alluring blend of excitement and substantial rewards for those who make well-informed choices. Yet, while the attraction of rental income and other potential gains is undeniable, taking your first steps into real estate investment can be both stimulating and challenging.

Real estate is a dynamic and complex field, fraught with hidden challenges that can impact your investment returns. That's why it's crucial to start your real estate journey fully equipped with knowledge. Engage in thorough research to uncover the multitude of opportunities and potential pitfalls, ensuring you're well-prepared to explore the exciting world of real estate investment.

Property Management: Being a Landlord

Investing in rental properties can be a great way to generate income, but it requires a significant amount of time and money.

- After choosing a suitable property, prepping it for tenants, and finding reliable renters, landlords must also factor in ongoing maintenance costs.

- Emergency repairs, such as roof damage, can eat into rental income, so it's essential to set aside a contingency fund.

- Landlords can manage their properties themselves or hire a property manager, who typically charges 8-12% of rent collected.

- Property managers can save landlords time and hassle by handling tasks such as maintenance, tenant screening, and rent collection.

- Rental property owners must also be familiar with the landlord-tenant laws in their state and locality, which govern rights and obligations related to security deposits, leases, evictions, and fair housing.

In addition to homeowners' insurance, landlords should purchase landlord insurance to protect their investments from property damage, lost rental income, and liability claims.

9 Crucial Factors to Keep in Mind

In the world of real estate investment, where every decision can make or break your success, the value of rental apartments isn't just about bricks and mortar. It's about the lifestyle you offer, the comfort you provide, and the dreams you fulfill. The following factors can help you achieve your ROI as soon as possible.

Amenities

Amenities are the silent yet powerful influencers in the world of rental apartments. They're the extra mile, the cherry on top, and the magic touch that can set your property apart from the competition. But what exactly are the amenities? They are the features and conveniences that go beyond the necessities of a dwelling. Think of them as the special perks and luxuries that can transform a rental space into a comfortable and alluring home.

Visit the neighborhood and explore the parks, restaurants, gyms, movie theaters, public transportation, and other amenities that appeal to renters. City Hall may have promotional materials that highlight areas where public amenities and private property are well-integrated.

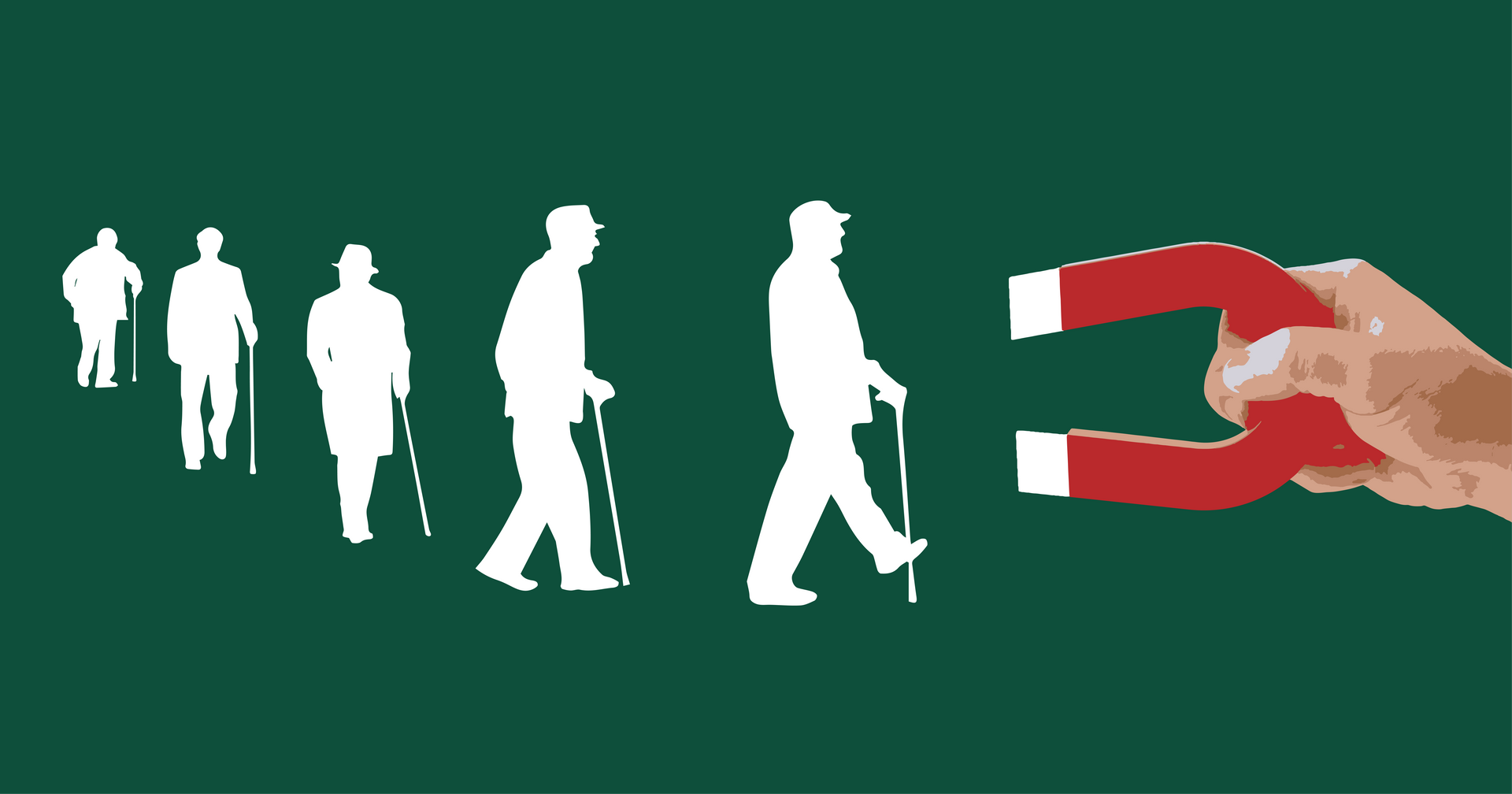

- Attracting Tenants: High-quality amenities act as magnets for prospective tenants. Whether it's a state-of-the-art gym, a pet-friendly policy, or secure parking, these perks appeal to a wide range of renters, making your property a sought-after destination.

- Retaining Tenants: Once you've attracted tenants, providing excellent amenities can keep them coming back year after year. Happy residents are less likely to leave, which reduces vacancy rates and ensures a steady income stream.

- Competitive Edge: In a competitive market, amenities can give you the upper hand. They can justify higher rents, and tenants are often willing to pay a premium for added comfort and convenience.

- Community Building: Amenities foster a sense of community among tenants. Spaces for socializing, working, and relaxing encourage interaction, creating a vibrant and engaged living environment.

Property Taxes

Property taxes may not be the first thing that comes to mind when you think about rental apartments, but they are a vital consideration for savvy investors. These taxes are imposed by local governments and are calculated based on the assessed value of the property. Understanding how they work and their implications can help you make more informed investment decisions.

These taxes are the cost of owning rental property and can vary significantly depending on the location. High property taxes are not necessarily a bad thing, especially in desirable neighborhoods where tenants are likely to remain for an extended period. However, there are also undesirable locations with high property taxes.

You can find property tax information at the municipality's assessment office or by talking to homeowners in the community. It's also essential to find out if property tax increases are likely in the near future. A town in financial distress may raise taxes significantly, making it difficult for landlords to cover their costs.

Strategies for Managing Property Taxes

Location Selection: Choose locations with reasonable property tax rates that align with your investment goals.

Tax Appeals: Please stay informed about local tax assessments and consider appealing if you think your property has been overvalued.

Passing Costs: Some investors choose to pass on a portion of the property tax costs to tenants through rent increases. Could you make sure this meets local rental regulations?

Continuous Monitoring: Regularly review property tax assessments and make adjustments to your financial planning as needed.

Neighborhood

Different neighborhoods attract different types of tenants. Some may be popular among young professionals seeking a vibrant city life, while others may cater to families looking for safe, quiet streets. Understanding your target market and matching it with the right neighborhood is the first step to success. A neighborhood isn't just a location; it's a community, a lifestyle, and a backdrop for your rental apartments.

The neighborhood you choose will affect the types of tenants you attract and your vacancy rate. For example, if you buy near a university, you'll likely have a pool of student tenants, which could mean vacancies during the summer. Please be aware that some towns attempt to discourage rental properties by charging high permit fees and making it difficult to obtain permits.

Choosing the Right Neighborhood

To select the ideal neighborhood for your rental apartments, consider the following factors:

Demographics: Research the local demographics to understand the type of tenants most prevalent in the area.

Crime Rates: Low crime rates are generally preferred by tenants, so be sure to check the crime statistics for your potential neighborhoods.

Schools and Education: Proximity to good schools is a significant draw for families.

Market Trends: Look at market trends to identify neighborhoods with growth potential.

Local Amenities: Evaluate the availability of essential services, transportation options, recreational areas, and shopping districts.

Schools and Education Level

If you're buying a family-sized home, consider the quality of the local schools. While your primary concern is likely monthly cash flow, the overall value of your rental property is also essential, especially if you plan to sell it in the future. If there are no good schools nearby, it can negatively impact the value of your investment.

Schools are more than just educational institutions; they are magnets for families, integral to the fabric of neighborhoods, and a key influencer in the rental apartment market. Whether you're considering a single-family property or apartments aimed at families, the proximity to quality schools should be high on your checklist.

To leverage the advantages of school proximity, consider these factors:

- Research school ratings and reviews to understand the quality of education offered in the area.

- Calculate the proximity of the property to the school. In some markets, being within walking distance can be a significant selling point.

- Depending on your target market, you may want to consider the proximity to both public and private schools.

- Stay informed about local education trends and any potential changes in school zones.

Crime Rate

Crime rates can significantly influence the desirability and profitability of a rental property. No one wants to live next door to a crime-ridden neighborhood. Check online state and municipal websites, the local police department, or the public library for accurate crime statistics. Pay attention to the rates for vandalism, serious crimes, and petty crimes, and note whether crime is increasing or decreasing. Also, ask about the frequency of police patrols in the neighborhood.

Crime's influence on rental apartments extends to several key aspects:

- Tenant Safety: Tenants prioritize their safety and the security of their belongings. High crime rates can deter potential renters and lead to higher vacancy rates.

- Property Values: Neighborhoods with lower crime rates tend to have more stable property values and higher potential for appreciation. Crime can erode property values in a community.

- Operating Costs: Property owners often incur additional expenses for security measures or insurance in areas with higher crime rates, reducing profitability.

- Tenant Retention: Tenants who feel unsafe are more likely to move out, resulting in turnover costs and potential income loss.

Future Development

It's not enough to focus solely on the present; you must also have your sights set on the future. One essential factor that can shape the success of your rental apartment investment is the potential for future development in the surrounding area. It's not just about what the neighborhood offers today; it's about what it promises for tomorrow.

Assessing Future Development Potential

- Research city planning and zoning regulations to understand what types of development projects are in the works.

- Infrastructure investments, such as new roads, public transportation, or utilities, can signal an area's growth potential.

- A strong local economy often attracts businesses and residents, fostering development opportunities.

- Active community involvement and neighborhood revitalization efforts can be indicators of future growth.

Rents in the Area

One of the most critical factors to consider is the prevailing rental rates in the area. Rental income is the lifeblood of your investment, and understanding the local rental market is paramount for success. Rental income is your primary source of revenue, so it's essential to know the average rent in the area. You need to choose a property that can generate enough rental income to cover your mortgage payment, taxes, and other expenses.

Could you do your research to understand the area's prospects? If you can afford the area now but taxes are expected to increase, an affordable property today could become a financial burden in the future.

Assessing Rental Rates in the Area

To evaluate rental rates in the area, consider the following:

- Local Comparable: Research similar rental properties in the vicinity to understand the going rates for comparable units.

- Property Amenities: Take into account the amenities and features of your rental apartments and how they compare to others in the area. This can justify higher or lower rates.

- Market Demand: Consider the demand for rental units in the area. A high demand may allow you to command higher rates.

- Local Economic Factors: Economic conditions, job opportunities, and cost of living in the area can all influence rental rates.

Job Market

Job market health is essential, as neighborhoods with growing employment opportunities attract more tenants. To learn about job availability in a specific area, check the U.S. Bureau of Labor Statistics (BLS) website or visit your local library.

If a major company announces plans to move to the area, you can expect an influx of workers looking for housing. Please note that the type of business involved may impact housing prices. However, if you're comfortable living near the company, your tenants likely will be too.

Assessing the Local Job Market

To evaluate the strength of the job market in your target area, consider the following:

Unemployment Rates: Review local unemployment rates and consider historical trends to assess the stability of the job market.

Industry Diversity: Investigate the diversity of industries in the area. A diverse job market is generally more stable than one reliant on a single sector.

Future Job Growth: Research job market forecasts and economic development plans to gauge the area's potential for job growth.

Wage Levels: Examine local wage levels to understand the earning potential of potential tenants.

Supply and Demand: The Role of Listings and Vacancies

If a neighborhood has an unusually high number of rental listings, it may be due to a seasonal cycle or a decline in the neighborhood's value. It's essential to determine which is the case. In either case, high vacancy rates force landlords to lower rents to attract tenants. Conversely, low vacancy rates allow landlords to raise rents.

Tenant Demand: A high number of listings and low vacancies may indicate strong tenant demand, making it easier to attract and retain tenants. This can result in more stable rental income.

Rental Rates: When supply exceeds demand, landlords may have to lower rental rates to attract tenants, which can affect your profitability.

Competitiveness: The number of listings can influence how competitive your rental apartments are in the market. A well-balanced supply and demand scenario can give you an edge.

Market Trends: Monitoring listings and vacancies can help you identify market trends and anticipate changes in demand or supply.

Conclusion

Investing in rental apartments presents a promising avenue for financial growth, but success requires careful consideration of several key factors. From amenities and property taxes to neighborhood dynamics and future development potential, each element impacts your investment's performance. By staying informed and proactive, you can navigate the complexities of real estate investing and achieve your financial goals.